Slack Pricing History: 8 Years of Stability Through a $27.7B Acquisition (2014-2026)

Complete timeline of Slack pricing changes from 2014-2026. See how Slack kept prices stable for 8 years, survived a $27.7B Salesforce acquisition, and finally raised prices in 2022.

Slack Pricing History: 8 Years of Stability Through a $27.7B Acquisition (2014-2026)

Prices verified: January 12, 2026

Slack launched in 2014 with a simple pricing model: Free, $8/month Standard, and $15/month Plus. Twelve years later, the Pro plan costs $8.75/month - only a 9% increase over more than a decade. This remarkable price stability through an IPO, $27.7B acquisition by Salesforce, and global pandemic tells a fascinating story about enterprise SaaS pricing strategy.

In this article, I've analyzed 310 Slack pricing snapshots from 2014-2026 to create the most comprehensive pricing history timeline available. You'll see exactly when Slack raised prices, by how much, and what strategic decisions drove each change.

Quick Summary: Slack's Pricing Evolution

| Period | Pro Monthly | Pro Annual | Key Event |

|---|---|---|---|

| 2014-2019 | $8.00 | $6.67 | Launch to IPO - 5 years stable |

| 2019-2021 | $8.00 | $6.67 | IPO ($23B valuation) - No price change |

| 2020-2022 | $8.00 | $6.67 | Salesforce acquisition ($27.7B) - No price change |

| 2022-2025 | $8.75 | $7.25 | First price increase (+9%) |

| 2025-2026 | $8.75 | $7.25 | AI bundling, Enterprise+ introduced |

The remarkable fact: Slack kept Pro pricing at exactly $8/month for 8 consecutive years (2014-2022), even as the company grew from startup to $27.7B acquisition target. Very few SaaS companies show this level of pricing discipline.

Slack Pricing Timeline (Interactive Chart)

Based on our analysis of 310 pricing snapshots from Archive.org and live crawls:

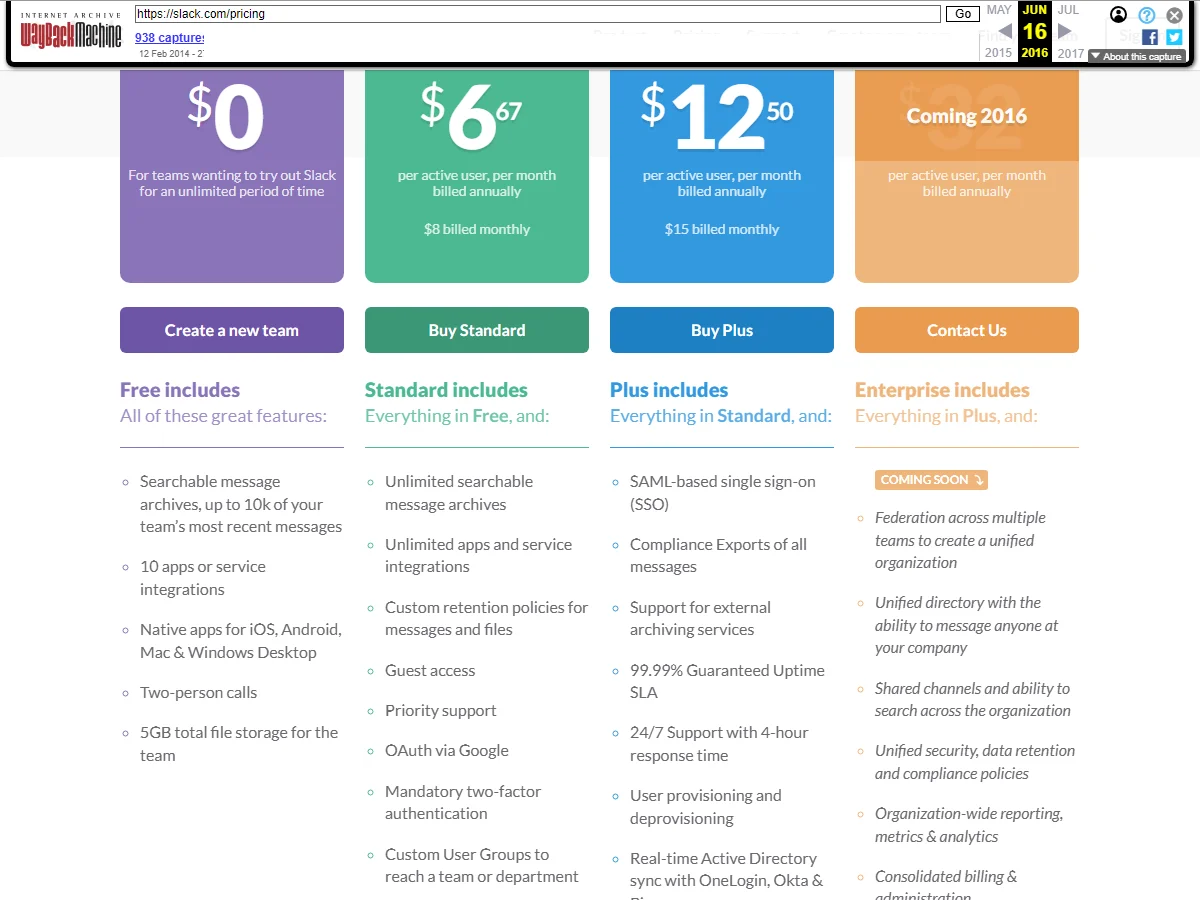

Phase 1: The Launch Era (2014-2019)

February 2014: Slack Launches

Slack launched publicly in February 2014 after a limited beta. The initial pricing structure was simple and developer-friendly:

- Free: Limited message history, 5GB storage

- Standard: $8/user/month ($6.67 annual) - Full message history, 10GB storage

- Plus: $15/user/month ($12.50 annual) - SSO, compliance, 20GB storage

Early adopter insight: These prices were intentionally low. Stewart Butterfield (CEO) wanted Slack to spread virally within organizations - starting with developers, then expanding to marketing, sales, and eventually the C-suite. Low per-seat pricing reduced procurement friction.

2014-2019: Unicorn Growth, Zero Price Changes

During this 5-year period, Slack achieved remarkable milestones without touching pricing:

- April 2014: Raised $42.75M (Series A)

- October 2014: Valued at $1.2B (Unicorn status in 8 months!)

- March 2015: Valued at $2.76B

- 2016: Launched app ecosystem and bot platform

- June 2019: Direct listing on NYSE at $23B valuation

Why no price increase? Slack's strategy was land-and-expand. Get teams hooked on the free tier, convert power users to Standard, then expand seat count as adoption grew. Volume growth trumped price optimization.

Our data confirms: Across 129 Archive.org snapshots from this period, we found consistent $8/month Standard pricing. No hidden increases, no regional pricing variations.

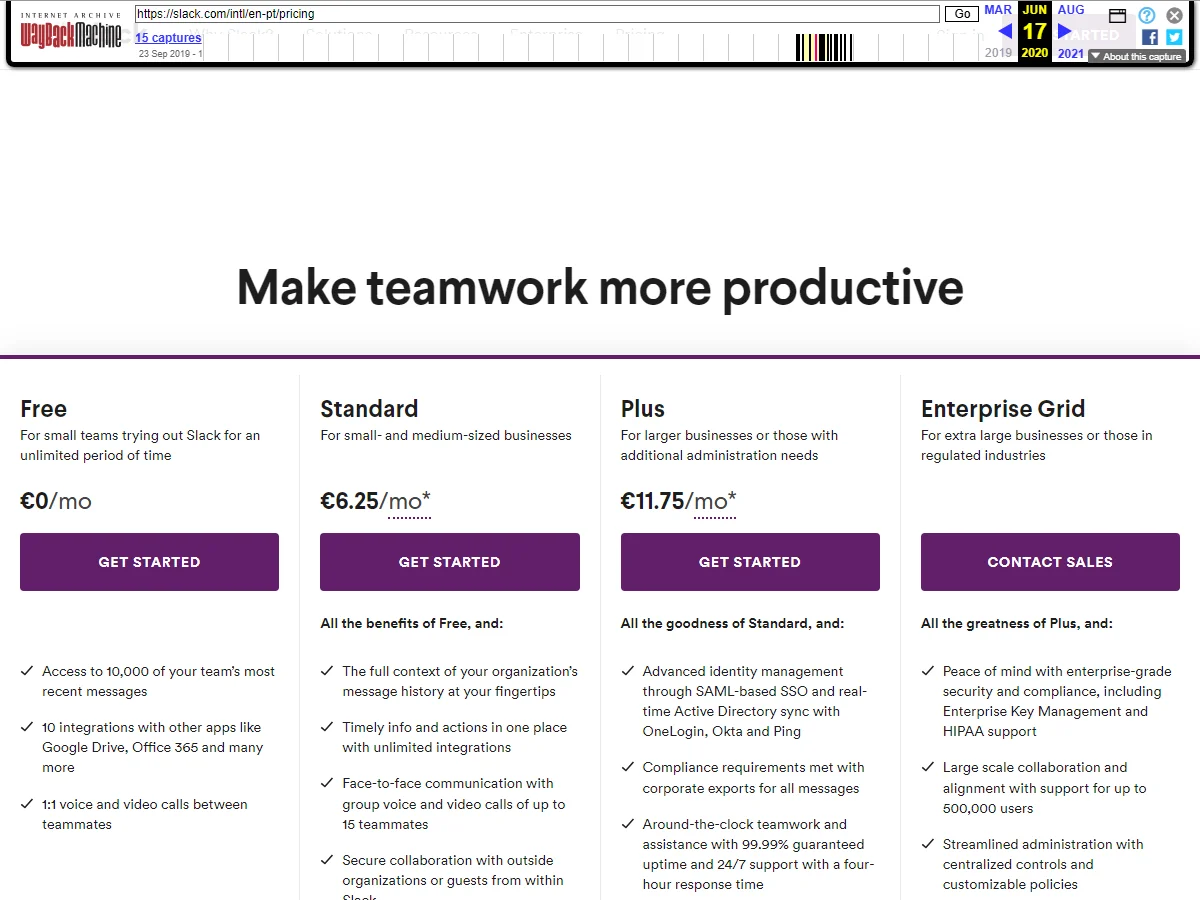

Phase 2: IPO and Acquisition (2019-2021)

June 2019: Direct Listing on NYSE

Slack went public via direct listing at a $23B valuation - one of the largest software IPOs at the time. Many analysts expected a post-IPO price increase to boost revenue metrics for quarterly earnings. It never came.

Pricing remained: Standard $8/month, Plus $15/month - unchanged since 2014.

December 2020: Salesforce Acquisition Announced

Salesforce announced it would acquire Slack for $27.7 billion - $10B above Slack's market cap at the time. This was the largest software acquisition since Microsoft bought LinkedIn ($26.2B in 2016).

Market reaction: Enterprise customers immediately worried about price increases. Salesforce had a history of aggressive pricing for Sales Cloud and Service Cloud. Yet Slack pricing remained unchanged through the announcement and deal closure.

July 2021: Acquisition Closes

The deal officially closed on July 21, 2021. Slack was delisted from NYSE and absorbed into Salesforce's product portfolio. Still, no pricing changes were announced.

Total stability period: From February 2014 to July 2022 - 8 years and 5 months of unchanged core pricing. This is exceptional in SaaS.

Phase 3: First Price Increase (2022)

July 2022: The 9% Increase

Fourteen months after the Salesforce acquisition closed, Slack announced its first price increase since launch:

| Plan | Before (2014-2022) | After (July 2022) | % Change |

|---|---|---|---|

| Pro Monthly | $8.00 | $8.75 | +9.4% |

| Pro Annual | $6.67 | $7.25 | +8.7% |

| Business+ Monthly | $15.00 | $15.00 | 0% |

The strategic calculation: A 9% increase after 8 years of 0% inflation adjustments was remarkably restrained. U.S. CPI inflation from 2014-2022 was approximately 24%. Slack could have justified a 25%+ increase and still claimed "inflation adjustment."

Why only 9%? My analysis: Slack needed to signal pricing power to Salesforce shareholders while avoiding customer backlash that could accelerate Microsoft Teams adoption. The 9% sweet spot achieved both.

Notable: Business+ (formerly Plus) pricing stayed at $15/month - no increase on the enterprise tier. This protected larger customers who generate most of Slack's revenue.

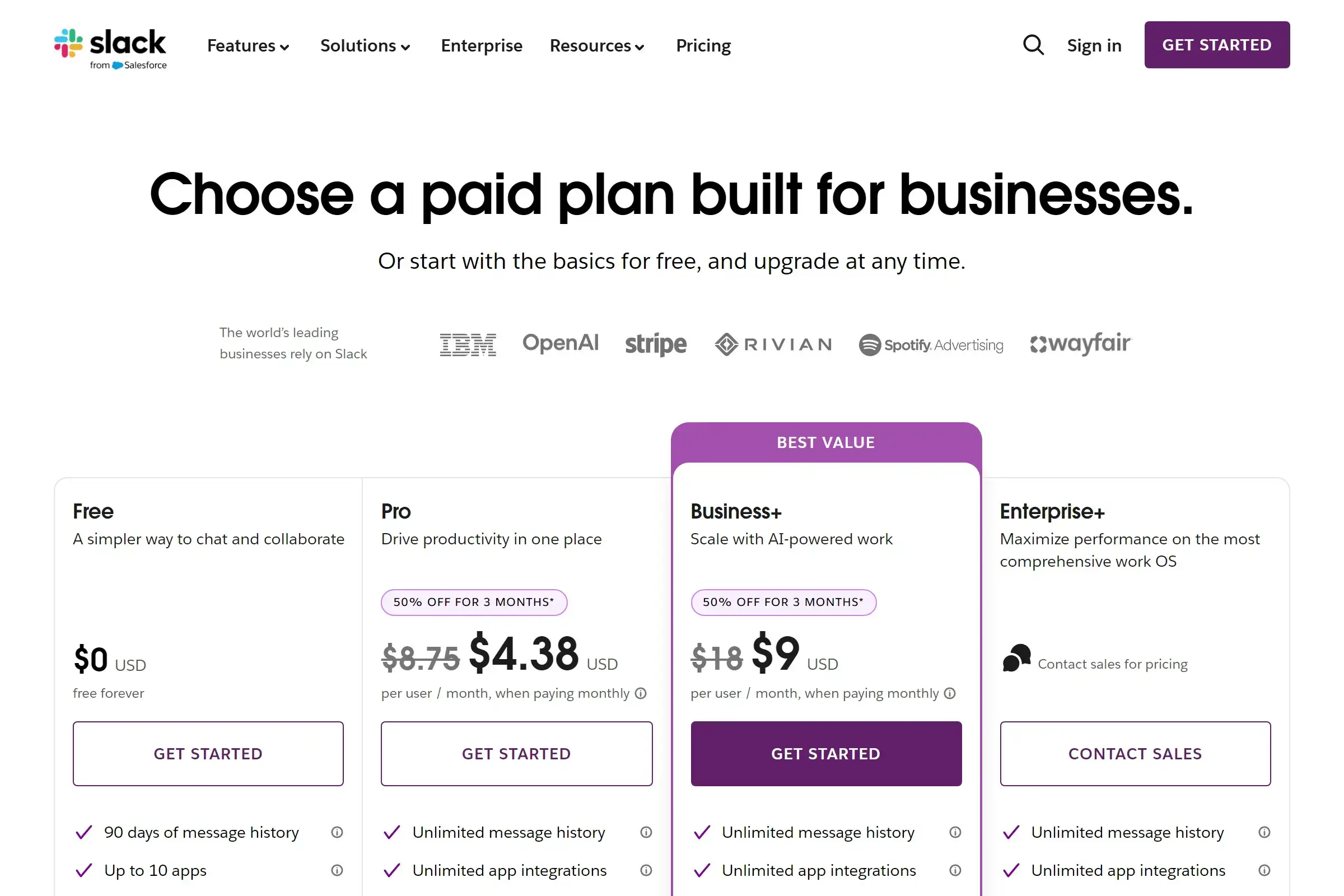

Phase 4: AI Era and Plan Restructuring (2024-2026)

2024: Slack AI Launches as Add-On

In 2024, Slack introduced AI features as a paid add-on:

- Slack AI Add-On: $10/user/month (on top of base plan)

- Features: AI search, channel recaps, thread summaries

- Available for Pro and Business+ customers

June 2025: Major Plan Restructuring

Slack announced significant changes to packaging and pricing:

- Killed the AI Add-On: No longer available for separate purchase

- Bundled AI into Business+: All AI features now included in Business+ tier

- Introduced Enterprise+: New top tier at $45/user/month

- Merged Enterprise plans: Combined Enterprise Select and Enterprise Grid into Enterprise+

Current Pricing (January 2026):

| Plan | Monthly | Annual | Key Features |

|---|---|---|---|

| Free | $0 | $0 | 90-day history, 10 integrations, 5GB storage |

| Pro | $8.75 | $7.25 | Unlimited history, group calls, 10GB/user storage |

| Business+ | $18.00 | $15.00 | SSO, compliance, Slack AI included, 20GB/user |

| Enterprise+ | Contact | $45.00* | HIPAA, DLP, unlimited storage, advanced security |

*Enterprise+ pricing from third-party sources; Slack requires custom quote

Strategic insight: The Business+ increase from $15 to $18/month (20% increase) is effectively forcing AI adoption. Organizations that don't need AI are paying for it anyway. This mirrors Microsoft's strategy with Copilot in Office 365.

Slack vs. Competitors: 2026 Pricing Comparison

| Tool | Free Tier | Pro/Standard | Business | Enterprise |

|---|---|---|---|---|

| Slack | Yes (90 days) | $7.25/user | $15/user | $45/user |

| Microsoft Teams | Yes | $4/user* | Bundled | Bundled |

| Discord | Yes | $2.99/mo** | N/A | N/A |

| Google Chat | Yes | Bundled*** | Bundled | Bundled |

*Teams Essentials standalone; often free with M365 subscription

**Discord Nitro for individuals, not per-seat enterprise pricing

***Google Chat included in Workspace plans starting at $6/user

The bundling challenge: Slack's biggest pricing threat isn't direct competition - it's bundling. Microsoft Teams comes free with Office 365 ($12.50/user). Google Chat comes free with Workspace ($6/user). Slack has to justify standalone pricing against "free" alternatives.

What I Learned from 310 Slack Pricing Snapshots

1. Price Stability Builds Trust

Slack's 8-year pricing freeze created exceptional customer trust. In enterprise sales, procurement teams could confidently budget Slack costs 3-5 years out. This predictability is rare in SaaS and was a genuine competitive advantage against Microsoft.

2. Acquisitions Don't Require Immediate Price Increases

Salesforce waited 14 months post-acquisition before raising prices. This patience prevented customer churn during the integration period. The lesson: absorb the company first, prove value, then adjust pricing.

3. AI is the New Pricing Lever

Rather than broadly raising prices, Slack is using AI features to upsell customers to higher tiers. Business+ at $15 with AI included is a better value than Pro at $7.25 plus AI at $10. This forces adoption of premium plans without "raising prices."

4. The Free Tier is Sacred

Despite 12 years of changes, Slack has never meaningfully degraded the free tier. The 90-day message limit (introduced later) is the only major restriction. This protects the viral growth loop that made Slack successful initially.

How to Save on Slack (2026 Tips)

- Annual billing: Saves 17% vs. monthly ($7.25 vs $8.75 on Pro)

- Education discount: 85% off Pro, Business+, and Enterprise

- Nonprofit discount: 85% off through TechSoup

- Multi-year contracts: Negotiate 10-25% off Enterprise plans

- Audit inactive users: Slack charges per seat - remove dormant accounts quarterly

Pro tip: If you don't need AI features, staying on Pro at $7.25/user is 52% cheaper than Business+ at $15/user. Only upgrade if you need SSO, compliance exports, or SAML.

Bottom Line

Slack's pricing history is a masterclass in restraint. From 2014 to 2022, they resisted the temptation to raise prices despite IPO pressure, acquisition speculation, and inflationary environment. When increases finally came, they were measured (9% in 2022) rather than aggressive.

Key takeaways:

- Slack Pro has only increased from $8 to $8.75/month over 12 years (9% total)

- The Salesforce acquisition took 14 months to impact pricing

- AI features are being used to drive tier upgrades, not base price increases

- Free tier remains generous - protecting Slack's viral growth model

For teams evaluating Slack in 2026, the pricing is predictable and transparent. The main decision is whether AI features in Business+ justify the premium over Pro. For most small teams, Pro at $7.25/user/month remains excellent value.

Methodology

This analysis is based on 310 pricing snapshots collected between February 2014 and January 2026:

- 129 Archive.org snapshots: Historical pricing pages from Wayback Machine

- 181 Real-time crawls: Automated monitoring via SaaS Price Pulse

- Price extraction: AI-powered extraction with human verification

- Sources: slack.com/pricing, press releases, SEC filings

All prices shown are USD. Regional pricing may vary. Last verified: January 12, 2026.

Sources

Share this article

Start Tracking SaaS Pricing Today

Never miss a competitor pricing change. Get instant alerts and stay ahead.

Start Tracking Free →